What is Cash App and is it Safe?

Cash App provides an easy way to easy way to send and receive money to friends and businesses as well as buy cryptocurrency directly from your phone.

Some apps become so popular that their name becomes a verb. The most obvious example is Google—we think nothing of telling someone to ‘Google it’ when they want to find some information. Cash App by Block is the latest app to reach the status of becoming a verb–Cash App. You may have already had people tell you to ‘Cash App me’ or even been sent a Cash App payment request.

So, what is Cash App, why are people using it, and is it safe to use? Let’s dig into the details.

What is Cash App?

Unlike many big-name apps, Cash App’s name gives a pretty solid indication as to what the app actually does. Put simply, the Cash App allows users to send and receive money in a secure way directly from their smartphones. Think of it as a simplified PayPal or Venmo.

While peer-to-peer cash transfers are the central feature of the app, Cash App also offers additional features, including buying and selling stocks (fractional shares supported,) filing your taxes for free, and even buying, selling, sending, and receiving Bitcoin through the app as well.

Lastly, as of October 2023, the Cash App is only available in the US and UK. You can send money back and forth between those two countries, but you can’t send or receive money from any other country.

How Does Cash App Work?

Cash App is quick and simple to use, which is one of the reasons that it has become so hugely popular. You can get up and running in a matter of minutes.

Setting Up Your Account

Download the app and register with a few details, such as your name, ZIP code, and mobile number. You don’t need to link a bank account to sign up, but you will need to do so in order to send and receive money.

Once you’ve created your account, you’ll be prompted to create a “$Cashtag”. The $Cashtag is a unique identifier, such as $groovypost or £princeharry. Choosing a $Cashtag automatically creates a shareable URL (https://cash.app/$yourcashtag) where friends, family, and customers can make payments to you privately and securely. From there, you’ll be asked to link your bank account or debit card information. Honestly, the setup is that simple.

If you haven’t done it already, you’ll need to link a bank account or debit card to your Cash App profile. If you don’t have a balance in your account, any payments will come from this source.

Fees

There’s never a fee to send or receive money to your Cash App balance. You can also withdraw cash to your Bank for free unless you need the cash quickly. In this case, Instant Deposits charge a 0.5% – 1.75% fee (with a minimum fee of $0.25) for the transaction.

ATM withdrawal limits are $1,000 per transaction, $1,000 in any 24 hours, and $1,000 in any seven days. Cash Cards work at any ATM but charge a $2.50 fee per transaction. Depending on the ATM you use, there may be additional fees; however, if you’re depositing $300 or more via paychecks into your Cash App account, they will reimburse you for some of these fees depending on the number of direct deposits you have set up.

How to Send Money in Cash App

Once you have an account linked, sending money is simple. If you’re sending money from the UK to the US or vice versa, Cash App will convert the funds to the recipient’s currency using the mid-market exchange rate at the time the payment is made. If your recipient doesn’t use the Cash App, that’s fine. They’ll receive a text or email when receiving a payment. From there, they’ll need to enter a bank account or debit card information to receive the Cash.

- Tap on the $ or £ sign at the bottom of the app.

- Tap the Payments icon. This is a dollar sign in the US or a pound sign in the UK.

- Enter the amount you want to send.

- Tap Pay.

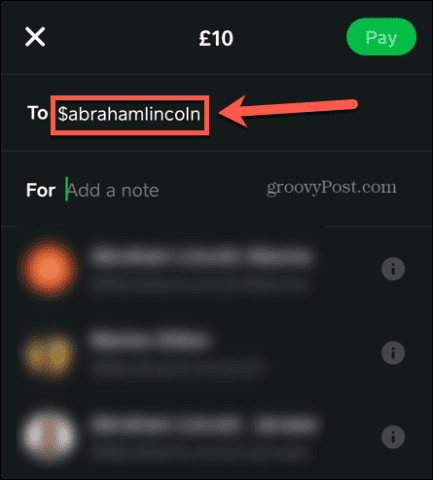

- Enter the recipient’s cashtag, phone number, email address, or select someone from your contacts.

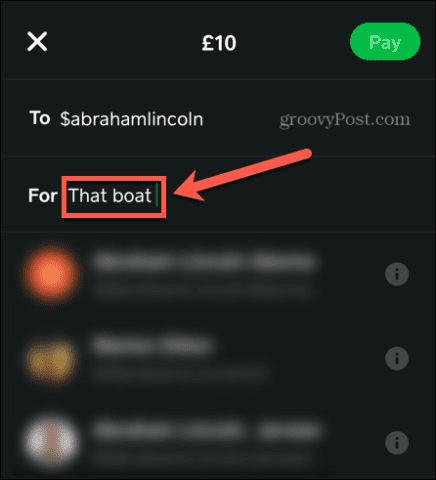

- You can also add a note explaining what the payment is for.

- Tap Pay, and your money will be sent. Note that in the UK, you may be required to enter some further identity details before the money is sent.

- The money will instantly appear in the recipient’s Cash App balance.

How to Receive Money in Cash App

Receiving money is also simple with Cash App. You can provide people with your cashtag, and they can use it to pay directly into your Cash App account, or they can do the same using your phone number or email address.

Alternatively, you can send them a payment request through Cash App.

To request money through Cash App:

- Tap the Payments icon.

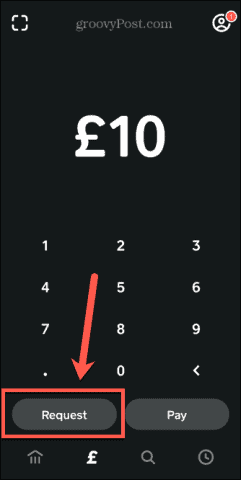

- Enter the amount that you are requesting.

- Tap Request.

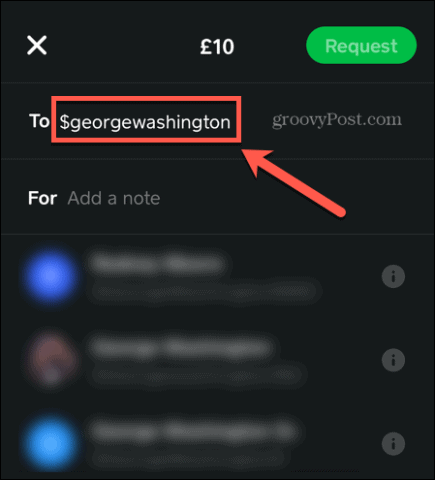

- Enter the cashtag, phone number, or email of the person you are requesting money from, or select someone from your contacts.

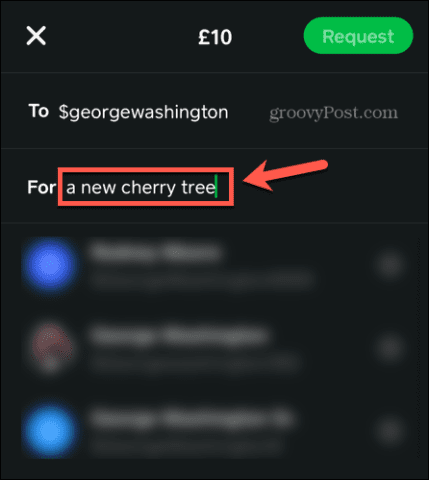

- Add a note explaining what the request is for.

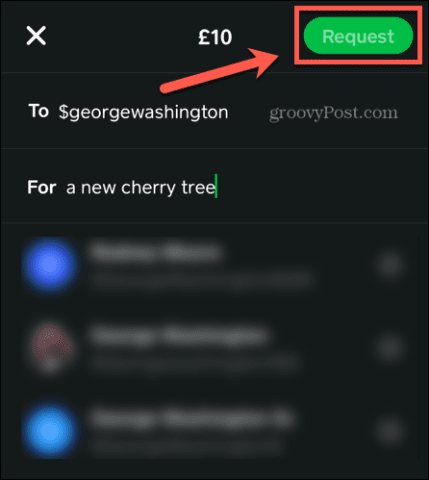

- Tap Request.

- The recipient has 14 days to send the requested money or decline the request, after which time the request will automatically be deleted.

- If they accept your request, the money will instantly appear in your Cash app balance.

Making Payments by Scanning

The Cash app also offers a scanning option that allows customers in the same location to send or receive money.

- Tap on the $ sign at the bottom of the app.

- Choose the “square” looking scan icon at the top left.

- To request money, show the person your unique tag by tapping the My Code button or tap Scan so you can use your mobile device’s camera to scan their unique $CashTag.

How to Transfer Money to Your Linked Account

Money that you receive will instantly appear in your Cash App balance. You can use this balance to make payments without taking any additional money from your linked account.

If you want the money in your bank account rather than your Cash App account, you’ll need to transfer it out. You can transfer the money out for free, but this can take up to three working days to complete, although it’s often quicker.

Alternatively, you can opt to deposit instantly, but Cash App will take a processing fee of between 0.5% and 1.75% of the amount you are transferring, with a minimum charge of $0.25.

To transfer money out of Cash App:

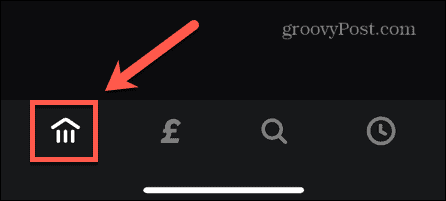

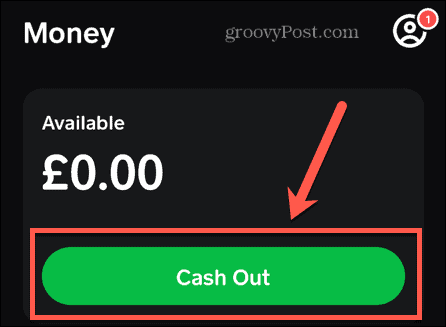

- Tap the Money icon.

- Under your current balance, tap Cash Out.

- Enter the amount you want to withdraw.

- Tap Cash Out.

- Select Standard or Instant withdrawal speeds. Remember that Instant requires a fee, and Standard is completely free.

- Your money will be transferred to your linked bank account within the chosen time frame.

What is the Cash Card?

There are times when going old school is still necessary, and that’s where the Cash Card comes in. The free Visa debit card lets you pay for goods and services from your Cash App balance. It’s not connected to your bank account or non-cash debit card. Compatible with both Apple Pay and Google Pay, the Cash Card is available in black or white. You can personalize your card by adding a signature or what’s best described as doodle art to the front. Yes, it’s gimmicky, but that’s okay.

You must be 18 or older to apply for a Cash Card. Cards should arrive within 10 business days.

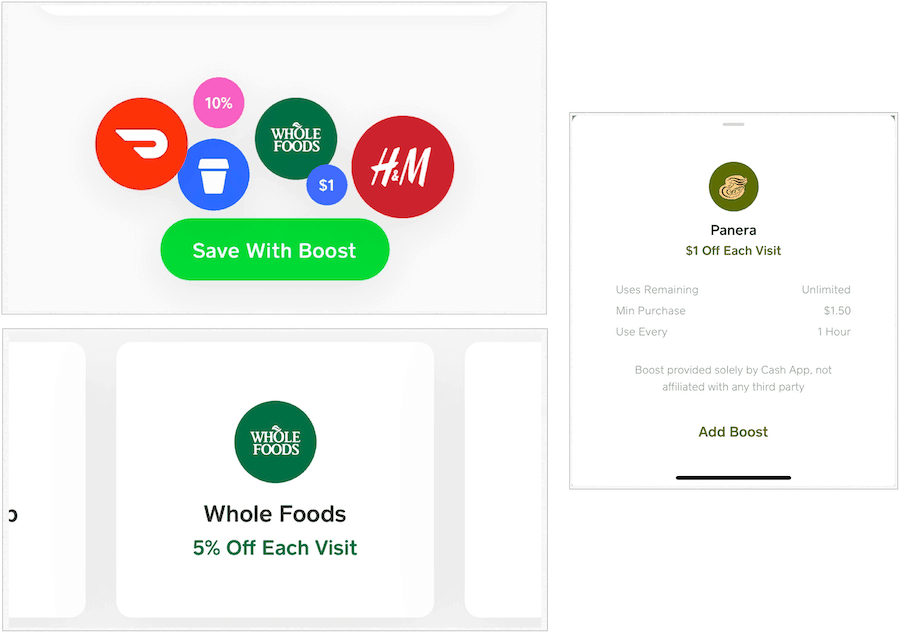

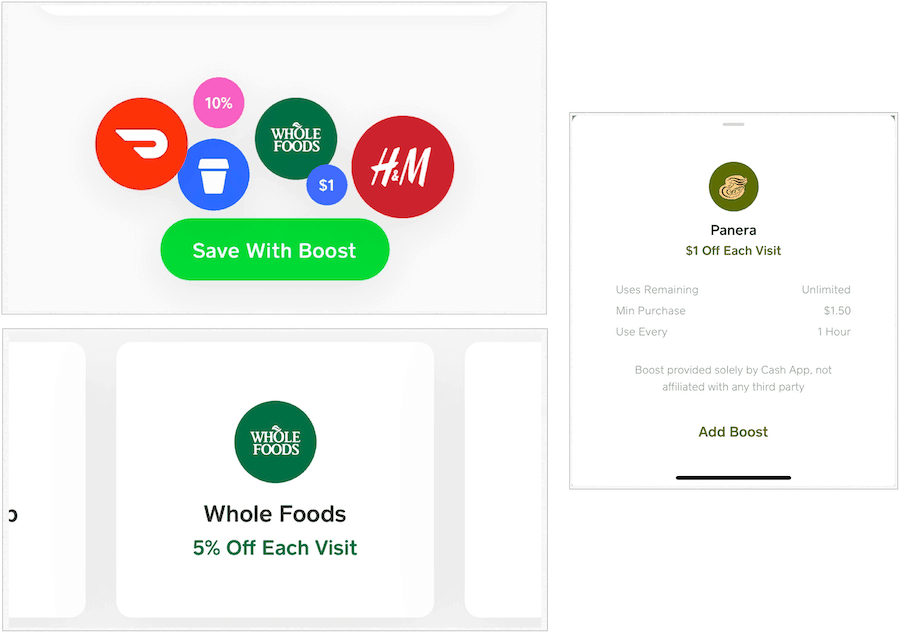

Get a Boost

With Cash Boost, you receive instant cashback for purchases made with the Cash Card. To do so, you select from the list of retailers offering a Boast from the Cash App before making a purchase. At the time of this writing, Panera, Five Guys, Whole Foods, and other retailers offer Boosts. You can only use one Boost at a time, and they can only be swapped every 24 hours.

Is Cash App Safe?

The short answer is yes. It’s as safe as most other payment apps, although, unlike your bank account, your money in Cash App is not FDIC insured. The company also goes to great lengths to keep its customers educated on how to keep their cash safe online.

Cash App uses encryption to protect your information and is PCI-DSS Level 1 certified, which is the highest level of compliance for processing banking card details. You can also set up Touch ID or a passcode to stop anyone using the app if they get hold of your iPhone.

For the protection of yourself and other Cash App users, there are also limits on how much money you can send and receive before you have fully verified your account.

The initial limits are:

- Send or receive up to $1000 within any 30-day period.

If you need more than this, you can verify your identity, which requires your full legal name, date of birth, and the last four digits of your social security number (or your full address in the UK). Once you have been successfully verified, you’ll have an unlimited cash balance.

Tips from the Cash App Team to help you not get Scammed Online

Cash App has been partnering with publishers online, including groovyPost, to help get the word out on how to stay safe online. At a high level, here are several tips whether you’re using Cash App, Zelle, or any other mobile payment service.

- Turn on notifications and enable Security Lock to keep your account more secure.

- Keep your information safe. Never provide sensitive information to anyone.

- Verify and double-check all recipient information before sending any payment to confirm you are sending money to the correct person.

- Don’t send money to someone promising you something in the future.

- Don’t send money to a love interest you haven’t met in person.

Finding Useful Apps on iPhone

Cash App is a safe, secure, and simple way to send or receive money quickly. If you’re willing to wait a little while for withdrawals, you can use it completely for free.

Cash App isn’t the only highly useful iPhone app out there, however. There are plenty of great iPhone apps you really should be using.

If you don’t already have a VPN app for your iPhone, you should definitely consider getting one. These apps not only allow you to view content from outside your current region but can also keep your data protected when you’re using the Wi-Fi in your local coffee shop.