What is Venmo and How Do I Use it?

Venmo is a mobile payment service that lets two or more users transfer funds through a mobile app. Created by two University of Pennsylvania students in 2009, Venmo has been owned by PayPal since 2013. Similar to apps like Cash App and PayPal, Venmo is ideally suited for sending small amounts of cash to split dinner or an Uber ride, get paid for freelancing, send a birthday gift, or similar activities. Because Venmo doesn’t charge a fee for most transactions, it’s a great way to transfer funds for other reasons as well.

Here’s everything you need to know about Venmo, how to sign up, and how to use it.

What is Venmo?

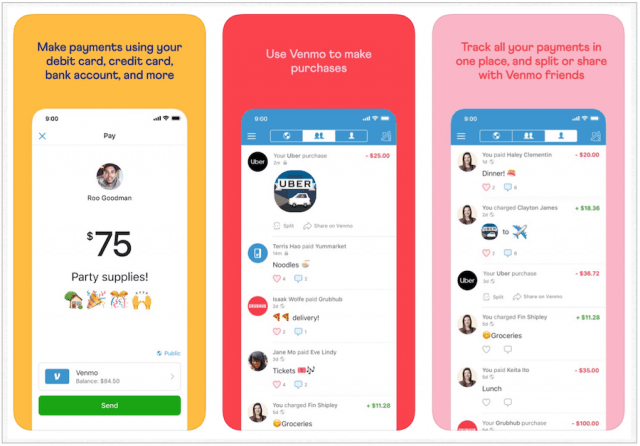

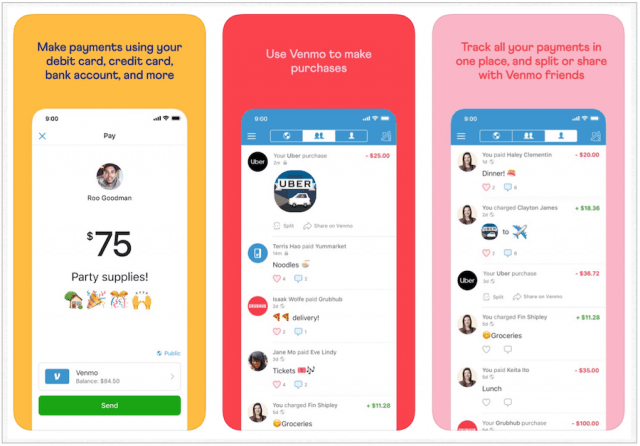

In its current form, Venmo allows users to send money using a phone number or email through the official Venmo app for iOS and Android. If you’ve sent money through Venmo and don’t yet have an account, you can create one in seconds for free. From there, you can find other friends and associates who use the service by syncing your Facebook account or phone contacts.

Since it first launched, Venmo has grown considerably both in the number of users and money-changing hands. For example, for the first quarter of 2019, Venmo announced it had 40 million users with a payment volume of $21 billion. Revenue for this year is expected to top $300 million.

How to Use Venmo

You can sign up for a free Venmo account through the official website or app. You can also create an account using your Facebook login or email. From there, you can begin receiving money or making requests.

Receiving Money

Standard transfers to your bank account are a free service; it usually takes 1-3 business days before you’ll see your money in your account. Instant transfers are available for both bank account and debit card transfers. As the name suggests, these transfers are completed immediately, giving you access to your cash in mere seconds. For this, Venmo charges 1 percent or a minimum of $0.25.

Sending Money

To send someone money through Venmo, you’ll need to know their email or phone number. By default, Venmo will pull the money out of your Venmo account. If there isn’t money in that account or you’re short, it will go down the list of accounts or cards you’ve attached to your Venmo account.

When you send money from a linked bank account, debit card, or Venmo balance, the service is free. When you use a credit card, the company charges 3 percent.

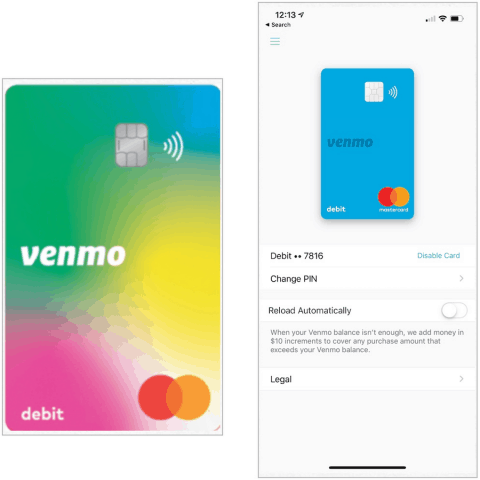

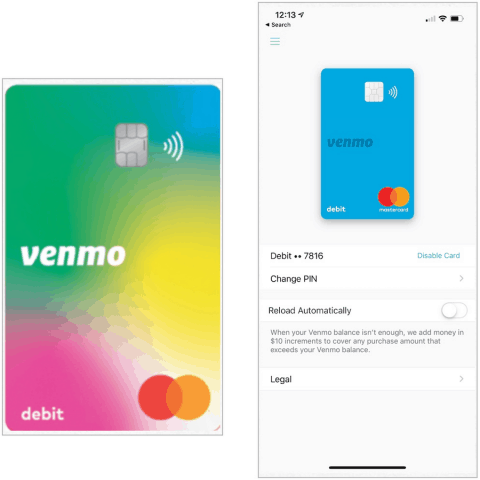

Venmo Card

In 2018, Venmo began offering a physical MasterCard debit card to users. The card provides ATM access and overdraft protection and is usable anywhere that accepts MasterCard in the United States. Venmo enables up to $400 in daily ATM withdrawals and charges $2.50 per transaction at non-Money-Pass ATMs. Otherwise, the debit card is free.

When enabled, the Venmo Card includes a reload function, which brings money from your linked checking account to the card in $10 increments. The feature kicks in whenever a purchase is made, and there isn’t enough money available. Card purchases are noted on your Venmo transaction history, and the card is easy to disable from inside the app if you misplace it.

Social Networking Aspects

Venmo has proven popular with millennials, which is probably one reason the service is packed full of social networking tools. Besides its integration with Facebook, Venmo lets you send bitmoji and select emoji whenever you send or request money. You can also elect to make your transactions public, either to all Venmo users or just your friends. From there, Venmo hopes you’ll comment on a shared purchase to begin a discussion.

I’m old school and prefer to keep financial transactions private between the sender and recipient. However, the sharing tools are here nonetheless.

PayPal Tie-In

Not surprisingly, PayPal has slowly added new features since buying Venmo. Besides adding instant transfers in 2018, the company has also implemented a PayPal Checkout-quasi Complete Purchase With Venmo feature for businesses. There’s also Venmo checkout integration that businesses can use for a mobile website or app. In other words, Venmo is no longer restricted to person-to-person money exchanges.

How to Send and Request Money through Venmo

- Tap the Venmo icon at the top right of the app.

- Select a friend(s) from your list, or add a name, Venmo username, phone, or email.

- Type in the amount to send.

- Add a note, bitmoji, or emoji.

- Tap Request or Pay.

- Select your bank information, when applicable.

- Tap Pay to send money or Request to send a request.

Payment Limits

Venmo’s current payment limits are as follows:

- Sending limit: $2,999.99 weekly

- Authorized Merchant Payments, $2,000 per purchase, 30 transactions per day

- Venmo Mastercard, $3,000 per purchase; ATM, $400 withdrawal daily limit

- Weekly limit, total $4,999.99.

Alternatives

Depending on your location, there are similar services to Venmo. These include PayPal, Cash App, and SuperPay. Each offers its own set of tools and fees; check out each one to see which is best for your situation.

I’ve been using Venmo off-and-on for many years and enjoy the convenience it provides for money transactions. Thanks to instant transfers, receiving cash from others has never been easier with fees I find acceptable. For more information on the service, visit the Venmo website.